Floify

Mortgage loan origination, processing, and servicing platform for brokers, small residential lenders, and loan processors

- Category Vertical Industry Software

- Languages English, Spanish

A comprehensive digital mortgage automation solution to streamline the loan process.

Overview

Floify is a leading provider of mortgage technology solutions, designed to streamline and automate the loan process. It is an end-to-end platform that simplifies the mortgage workflow, making it easier for both lenders and borrowers.

Key Features

The platform's most significant feature is its document management system. It allows lenders to collect and verify loan documents from borrowers and third-party providers, reducing the time spent on paperwork. This feature also enables lenders to customize document checklists based on loan type or individual needs.

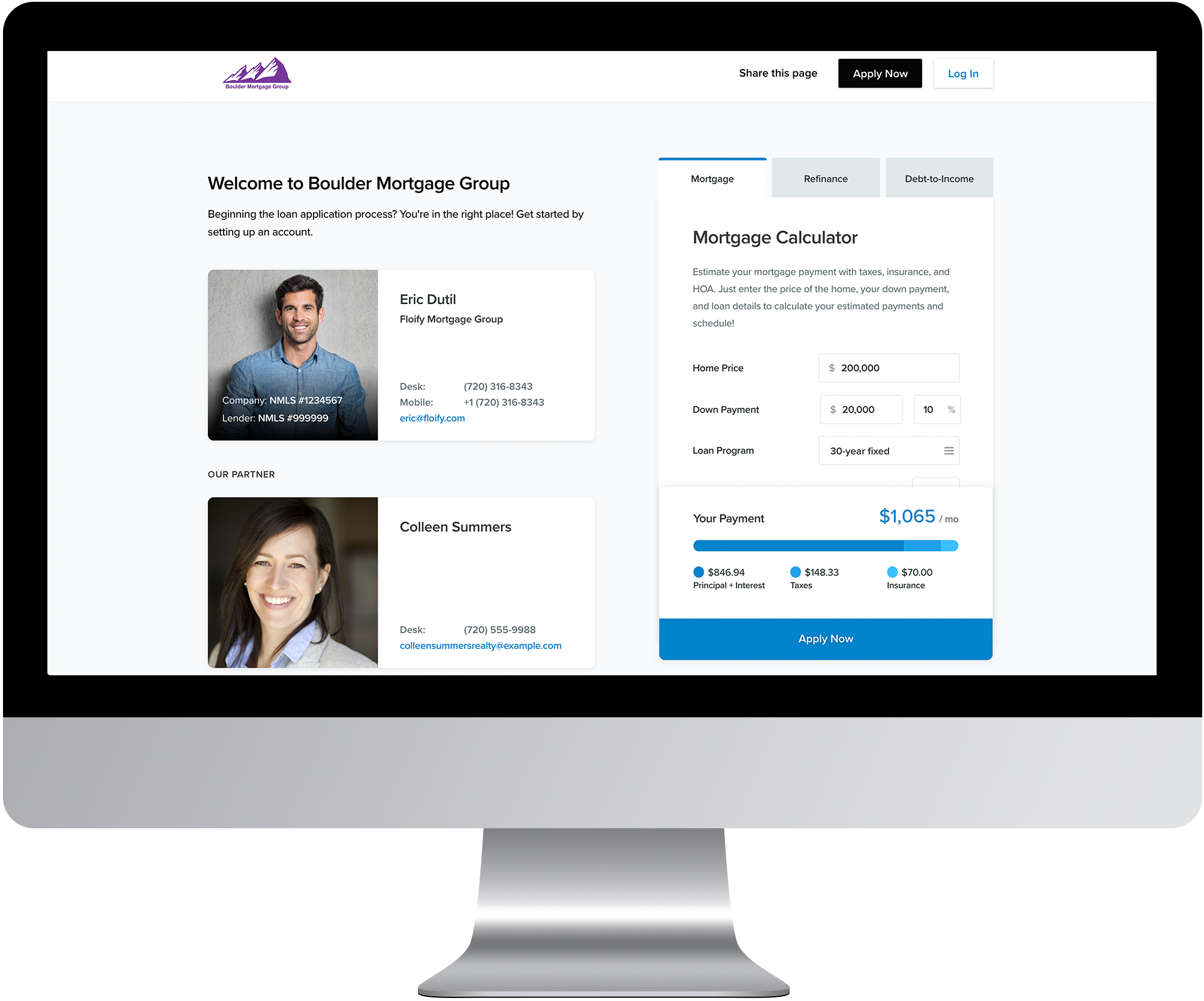

Another notable feature is the point-of-sale solution, which enables borrowers to fill out a digital 1003 loan application, track their loan status, and interact with their loan officer.

Floify also provides automated milestone updates that keep everyone involved in the loan process informed about progress. These updates can be sent via email, text message, or through the platform’s dashboard.

User Experience

Floify offers a highly user-friendly and intuitive interface that simplifies the mortgage process for all parties involved. The platform's dashboard is easy to navigate, making it simple to track loan progress, manage documents, and communicate with borrowers.

Integration and Customization

One of the things that sets Floify apart is its integration capabilities. The platform can seamlessly integrate with major credit reporting agencies, LOS systems, and third-party cloud storage providers. Additionally, its API allows for further customization and integration with other systems.

Security

Floify takes security seriously. It uses 256-bit encryption to protect data, adheres to strict compliance standards, and offers role-based permissions to ensure that sensitive information is only accessible to authorized personnel.

Conclusion

In all, Floify is a robust mortgage automation platform that can drastically reduce the time and effort required for loan processing. Its array of features, ease of use, and integration capabilities make it an excellent solution for both lenders and borrowers.

- Company

- Floify

- HQ Location

- Boulder, CA

- Year Founded

- 2013

- LinkedIn® Page

- https://www.linkedin.com/company/2451048 (40 employees)

- Business: $79/month

- Team: $250/month